CRS4 talks to Davide Carboni about the scientific school on blockchain technologies

The CRS4, jointly with University of Cagliari and Associazione Bitcoin Sardegna, organize the first Blockchain and Distributed Ledger Scientific School that will be taking place 12-15 June 2018 at the Science and Technology Park of Sardinia (Italy). The school is aimed at researchers, Phd students, scholars and technologists in industry and academia, not excluding under or new graduates with strong technical drive and with the sufficient background to successfully attend the lectures. Starting from the results of other initiatives, such as the Contamination Lab of the University of Cagliari, selected participants will access the courses to acquire the technical skills to develop entrepreneurial ideas in the blockchain space. The school has been organized thanks to the financial support and collaboration of the regional agency Sardegna Ricerche, through grant "Scientific School 2017/18".

More informations available at http://blockchain2018.crs4.it/

In this focus Davide Carboni, coordinator of the school, answers some questions about blockchain, cybersecurity and cryptocurrencies.

Davide, CRS4 will play a role in the research on blockchain as was in the birth of the web in Italy?

We are working hard to play a role, but differently from early 90s, CRS4 has not gained much visibility in this space so far. Differently from the web or other internet protocols, Bitcoin was born outside institutions and fuelled by a bottom up community. Even academia is lagging in this respect, now there is a flourishing of conferences, journal issues and courses. There is nothing wrong with that, cryptocurrencies are not a new kind of science, they are basically an application of cryptography. After 9 years from the invention of Bitcoin it is now time to study their multifaceted aspects, from technology to finance.

A few weeks ago you tweeted that censorship is always wrong and that financial education for the masses is the way. What did you mean by that?

This tweet came after Facebook ban of ads for cryptocurrencies and ICO. Also some content of mine was banned by Facebook and I needed to appeal and explain, I was right and then republished. I understand that a webplace like Facebook is committed to protect users from scammers and frauds, however this puts too much power in the hands of a privately owned company. Recently also Google is banning ICO ads. Nothing wrong again, in theory it is a privately held company and can do whatever it wants, but there is a huge oligopoly in the web and few CEOs decides what is right and what is wrong for everyone. I don’t feel comfortable with these settings, I prefer that people can read any kind of financial proposal and can distinguish a risky business, from a scam. Nobody is forced to buy futures or cryptocurrencies, but on the other hands making them subject to ban is a power abuse. Financial education should be a topic since the primary school. It is unbelievable that in 2018 the majority of people cannot understand what is a compound return or is unable to distinguish bonds from futures. I guess many account holders of notorious bankrupted banks would be on a safe side by now if they were educated on these topics since school, and the cost of bailing out wouldn’t be today on the shoulders of the taxpayer.

And then it comes the concept of freedom and responsibility. I prefer more personal freedom and more personal responsibility rather than the opposite.

How, in your opinion, cryptocurrency hackers are creating new jobs, in the field of cyber security and so on?

They are creating jobs because they are creating new business in the best way possible, from bottom up and with a lot of trial and error. They are taking risk, and sharing this risk with coin holders. It is a boiling pot with hundreds of new ideas coming out every month. Along the lines of what happened in the 90s with the dotcom era, where some projects were good the others simply faded away. Today we have Google, while in the early 90s we used Altavista and the cost of this evolution is also in the money wasted with pets.com.

All the cloud based services now are rethought with some flavour of decentralization and some role for a cryptocurrency. Of course, most of them are just nonsense and won’t be lasting more than few months. But this is the antifragile nature of this market, failures make it stronger and more solid. A few of them will be able to revolutionize entire markets like ecommerce, car sharing, home rental, venture capital and so on. Just a matter of time and we will see how, or if we want to be involved let’s try to shape ourselves some of them.

Why is Bitcoin controversial?

There is plenty of reasons. First and foremost, Bitcoin was born outside any kind of “institutional” bodies. An anonymous inventor and twenty years of cypherpunk subculture is behind this project. Second reason, it defines something which is totally new, not money and not data. A cryptocurrency cannot be aligned in any of the preexisting categories and as such it is a huge puzzle for regulators and for the banking system to understand how to move in this space. Democracy (as we know it today), banks and currency are three sides of a triangle, no two side can stand without the third. Bitcoin is like a wedge that can question this triangle. From one side, no authority can actually ban Bitcoin because of the underneath technology, the cryptography. For the first time in the humankind history, technology gives to individuals a defense able to stand against state level attacks. And this is why it is controversial, too much power is out of reach. As it happens for every technology, Bitcoin is not bad or good. Of course some ominous things like Silk Road happened, and the responsibles are now jailed for life. Last and not least, greed can bring people to lose money and a lot of. The fear of missing out is that state of mind where people decides to buy Bitcoin when everyone buy and to panic-sell when the trend is bearish.

On Ledger, a peer-reviewed scholarly journal that publishes original research articles on cryptocurrency and blockchain technology, we can read a paper (From Smileys to Smileycoins: Using a Cryptocurrency in Education) that describes a cryptocurrency to reward students for their studies, as a good key to improve their school results. Perhaps this shows that cryptocurrency and blockchain technology are going far beyond the starting point?

Do I really need a blockchain? This was the title of a workshop I recently co organized in London. In many cases, technologists wander handing the “blockchain” as a solution in search of problems. Experimenting is always good, and I’m personally involved in the creation of a blockchain reputation token that we are using in few communities to reward participation and contribution. It was initially born as the Cagliari Ethereum Lab token. The real question is: can I do the same without a blockchain? Of course, a single community or a single company can issue tokens without using a blockchain. We have loyalty points since ages. The novelty of blockchain is required when many actors want to federate this distribution of value or credit among different communities or organizations. Without a blockchain, I would need someone trusted by all to issue and manage the “currency”, today I have the blockchain as a liquefied trust container where nobody is in charge. I like to say that “you don’t need a blockchain to build a product, you do need a blockchain to build an ecosystem which in theory can thrive even without you”

Davide Carboni, graduated in Electronic Engineering at the University of Cagliari, completed a scholar internship at the IMS laboratory in Bordeaux (FR) and received a PhD in Informatics from University of Sherbrooke (Quebec) in 2005. He joined CRS4 as software engineer in 1999. In 2015 joined Intel labs Europe and the Intel Collaborative Research Institute (ICRI) hosted inside the Imperial College of London to work on machine learning for urban environments and to develop a number of solutions in the space of blockchain, IoT and digital wallets. As for 2018, he is in charge of bootstrapping an emerging program in the space of cybersecurity and cryptocurrencies inside the CRS4.

He is co-organizer of the IoT and Blockchain meetup regularly running in London every 2 months, and co-organizer of the Cagliari Ethereum Lab, the first meetup community with a ERC20 reputation token.

— A. Mameli

Technical Corner

The key is the key

A great invention such as Bitcoin does not come from the Moon. Its inventor "was sitting on the shoulders of giants", and brought it to us thanks to some very important preexisting technologies. One of these is the digital signature. Perhaps you have had to deal with digitalized signatures: for example, when asking permission for leave from your manager you sent your company office a request form with your signature on it. The form was pretty much just a file that you edited with Acrobat or other equivalent software. That’s not a digital signature. That is a dangerous practice that is now becoming widely adopted and that sooner or later will cause trouble. These types of digitalized signatures, as well as scanned copies of paper documents and so forth, should have no legal value. Worse, requests for these documents to be transmitted over the network create a security flaw that jeopardizes people’s identities, as they are easy to counterfeit and attach to any statement. And today there is no bank or financial service that does not require you to provide these documents.

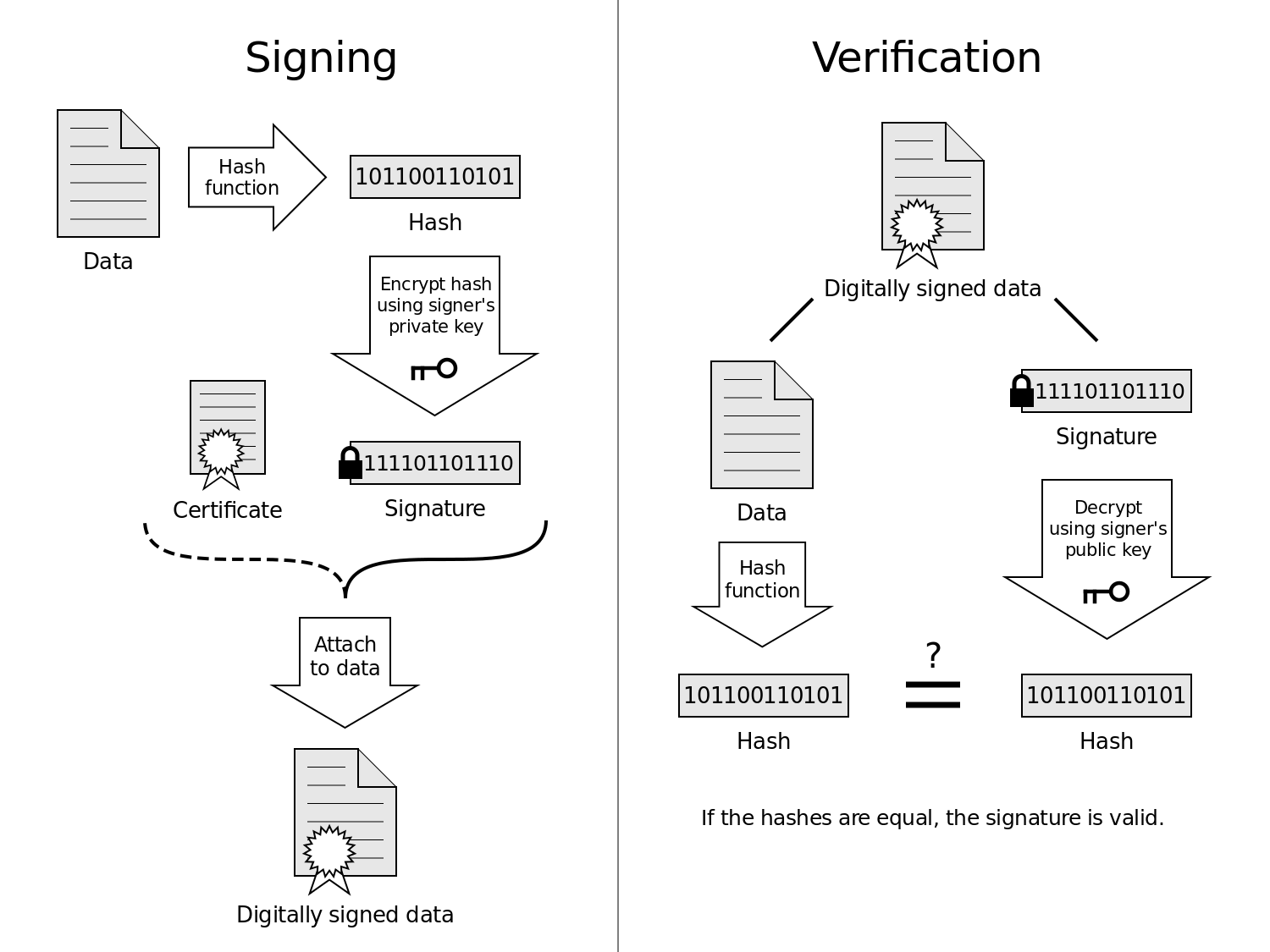

A true digital signature is a mathematical proof that you actually wrote a digital document. It is based on two other digital objects: the public key and the private key.

A key is a sequence of digits, such as a PIN, but hopefully much longer, which together with a mathematical operation can transform plain text into cipher text and vice versa. So far there is no magic, no wow effect. Julius Caesar enciphered messages by replacing letters with each other according to a certain code, and the Enigma was a piece of German engineering that did the same, although in a much more complex way. Combining the message with the key you get the cipher text, and using the same key with the reverse procedure you get the original message. It's like having a treasure chest that needs one key to be locked and another to be opened.

Then, one day asymmetric encryption was invented. In practice there are two keys, one to encrypt messages and the other to decrypt them. And here the magic begins. Think again of the treasure chest, but this time it can be locked with either one of the two keys, and only opened with the other.

So for example, I can decide to keep one key secret and publicize the other, putting it on my Facebook profile or writing it on the doorstep. Then I can receive messages encrypted by everyone (anyone can use my public key) and be the only one who can decipher them with my private key. I can also send encrypted messages with my private key to everyone. Everyone will immediately decipher them with my public key and be able to prove that it was I who actually created them.

The second option is the basis of the digital signature. In fact, this encryption and decryption is a mathematical proof that whoever has encrypted the text is the one who possesses the private key.

Let’s go back to Bitcoin; a Bitcoin payment is like writing a check that we have received from another user, who in turn had received it from another and so on until you go back to the first moment when the check (i.e. Bitcoin) was generated. The difference compared to regular checks is that clearance is always guaranteed. Writing the check is carried out with a digital signature and transaction publicity is ensured by the fact that the payment (read transaction) is inserted into the universal register (the blockchain) that everyone can download and inspect.